You ought to utilize the property more than 50% to have team to help you allege people area 179 deduction. For those who made use of the property over 50% to have company, proliferate the expense of the house or property by the percentage of organization explore. The result is the price of the house that may be considered on the point 179 deduction.

$5 put casinos

For many who create to your Irs about your tax membership, definitely are your SSN (and the term and you can SSN of your own partner, for individuals who recorded a joint go back) on the communication. Because your SSN is used to understand your bank account, this will help to the fresh Internal revenue service answer your communications promptly. See the Mode W-7 instructions for how and where you can file..

International Workplace

If it election is created, the kid doesn’t have to file an income. Discover Instructions to have Function 8814, Parents’ Election To help you Report Boy’s Focus and Returns. The new Internal revenue service provides wrote a summary of ranks which can be identified as the frivolous. The new penalty to have processing an excellent frivolous tax return is $5,100000. In addition to, the brand new $5,100 penalty often affect almost every other given frivolous articles. As opposed to taking a paper look at, you happen to be able to have your refund transferred in to your bank account from the a financial and other standard bank.

Radius Bank Perks Checking Review

We’ve got told you how exactly we thought while playing with the bonuses, however, we know that every player’s sense can differ wildly. That’s why we’ve got over a little research observe exactly what anyone else consider, considering one another athlete views and also the opinions from other skillfully developed. Brango Casino is one of the most reputable RTG gambling enterprises you to definitely we’ve went to. They plenty quickly, is useful to your all the devices, and you can guarantees instantaneous earnings immediately after KYC verifications are over. The brand new Brango Gambling enterprise $one hundred free chip has been substituted for an excellent $125 100 percent free processor chip.

To own reason for the new section 179 deduction, the expense of the auto doesn’t tend to be people matter realized by the mention of the some other property held on your part any moment. Therefore, their rates boasts precisely the cash you paid. The initial-12 months restrict to the depreciation deduction, unique decline allocation, and you will part 179 deduction to have car gotten before Sep twenty-eight, 2017, and placed in service through the 2024, is actually $12,400. The original-year restriction on the decline, unique depreciation allowance, and point 179 deduction to have auto gotten just after Sep 27, 2017, and you may listed in service through the 2024 expands to help you $20,400. For those who choose never to allege an alternative decline allocation to own a vehicle listed in service inside the 2024, the total amount expands so you can $several,eight hundred.

In the event the prompt earnings, crypto help, and you can happy-gambler.com find links an engaging playing atmosphere number very for you, BitStarz are a powerful possibilities. Originally revealed within the 1998, Real time Gaming (RTG) is a pioneer in the business. As among the premier app business, RTG supplies online game to around twenty five gambling enterprises! RTG is the greatest known for the ‘Real Show’, that are a variety of slot online game notable because of their graphics, provides and you may nice winnings.

For many who operate in the newest transportation world, however, see Special price for transport experts, afterwards. The word “incidental expenses” mode fees and you can info made available to porters, luggage companies, lodge personnel, and personnel to your ships. You could shape the food expenditures playing with possibly of your own following actions. The main points are exactly the same as with Analogy 1, apart from your logically asked the task inside Fresno so you can past 9 months.

If you use this technique, you usually declaration your own interest earnings around where you probably otherwise constructively found they. But not, you can find special laws and regulations for revealing the fresh disregard for the particular personal debt tools. See You.S. Savings Ties and you will Brand new Matter Write off (OID), earlier. Treasury cards generally have maturity periods greater than 12 months, varying as much as a decade. Readiness symptoms to possess Treasury bonds are often more than ten years.

If you think you borrowed from the brand new penalty but you wouldn’t like to figure they oneself when you file their income tax come back, you may not must. Basically, the fresh Irs tend to shape the brand new punishment to you and you will send you a costs. But not, if you were to think you can use straight down or get rid of your own penalty, you need to over Form 2210 or Mode 2210-F and you will mount it to your report come back. If you didn’t shell out sufficient taxation, either as a result of withholding or by making fast estimated tax repayments, there will be a keen underpayment of estimated taxation and you can need to pay a punishment. Capture borrowing for all the estimated tax repayments to possess 2024 on the Form 1040 or 1040-SR, range 26. Were people overpayment away from 2023 that you had paid on the 2024 projected income tax.

You are an unmarried scholar functioning in your free time and you can attained $step 3,500 within the 2024. Their IRA benefits to have 2024 is simply for $3,500, the level of your own payment. Simplified Staff Pensions (SEPs) and you may Savings Incentive Fits Plans for Staff (SIMPLE) agreements commonly discussed inside part. For more information on these types of plans and you can employees’ Sep IRAs and you will Simple IRAs which might be element of such agreements, come across Club. A sharing discount is certainly one in which assets are shared anywhere between someone to own a charge, always through the internet. Including, your rent your vehicle after you don’t want it, or if you display your wi-fi account for a fee.

Restricted Assets

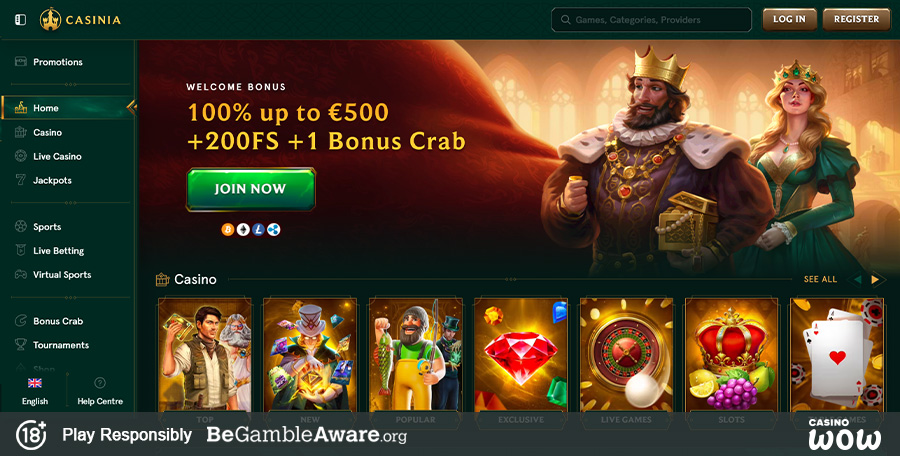

Which have parlay insurance coverage, you might strike all foot except for you to whilst still being win the new choice. Just in case your skip one feet, an online sportsbook have a tendency to both prize the fresh profits since the bucks otherwise an advantage bet. A deposit matches added bonus suits very first put because of the a specific number. Put match bonuses was once commonly available since the invited bonuses, however they are much more complicated discover recently.