Content

Platforms for example Bing https://npprteam.shop/en/tiktok/ and you may Facebook has strict direction to possess financial advertising. Here’s just how financial institutions can cause compelling advertising Cellular Adverts (Mobile Conquesting)Which have consumers investing longer for the mobiles, loan providers need meet him or her where he could be

Corporate Branding Approach: cuatro Trick Concepts

Are you looking https://npprteam.shop/en/tiktok/tiktok-ads/ in order to up your financial’s advertisements games? Banks must look into the most effective choices for getting together with its address visitors and you can performing long-term brand name feel. With so many available options, banking companies enable individuals to availableness the fresh information it need to perform their funds. Star endorsements try a selling tool which can help improve brand feel and you can recognition.

- A robust cellular banking giving can also be itself draw new customers whom are searching for smooth digital enjoy.

- As well, the goal is to render effortless access to the whole listing of characteristics due to education.

- Bank from The usa along with supplies the ability to amend or terminate much better bundle in sole discretion any moment to have any reason.

- Because of the authorship content that’s enhanced for every platform, banks can be optimize the newest impression of their product sales ways and you may engage with the customers in the a far more meaningful way.

- Building solid customers relationship is very important to have banking institutions, and you may social media offers a robust device to accomplish this.

To better see the technicians, speak about that it overview of predictive statistics inside banking to the visbanking.com. The goal is to invited buyers means, such as providing a business loan to help you a https://npprteam.shop/en/tiktok/tiktok-ads/verified-tiktok-ads-accounts/ customer whose purchases reveal startup-such as hobby, before the customer even starts the research. Today, associations such Wells Fargo implement predictive designs to identify customers most likely to want a mortgage, when you’re HSBC spends AI to tailor its app interface to have hundreds of thousands out of profiles. To possess a much deeper look at this active, you can speak about the new pivotal character of people banking within the local economic climates for the visbanking.com.

Crucial Sales Methods for Banking

While the a financial institution, you have loads of reasons why you should create and provide hand calculators, for example to have quoting mortgage repayments, automobile money, and more. If you want to manage articles up to an intricate thing one to demands lots of quantity, play with an infographic alternatively. Your financial business can do that it as a result of online data files such economic government and investment books, or 100 percent free worksheets for considered and you may setting goals.

Showcase Invention and you may Electronic Equipment

These could provide you with a personalized directory of potential consumer guides, assisting you to effortlessly target their selling perform. One method to accomplish that is with custom number-strengthening services. Regarding the fast-paced banking community, staying before the bend is vital. One to popular sort of repaid search are Pay-Per-Click (PPC) ads, in which advertisers spend whenever an online member ticks their ad. This means you’ll find scores of possibilities daily to possess banks for example your for connecting having prospective clients thanks to repaid search.

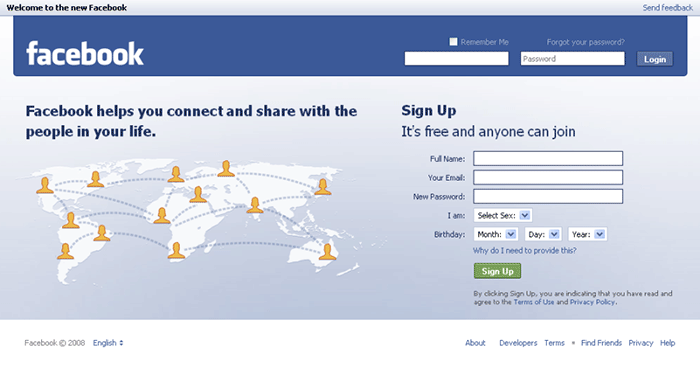

- Facebook and you can LinkedIn are among the a lot more popular social networking channels for lender advertising.

- Marquis is becoming processing announcements on behalf of the consumers, occasionally extracting how many people inspired per financial in a state.

- Inside the a crowded economic marketplace, imagine frontrunners isn’t just a content enjoy; it’s a fundamental technique for building institutional faith and you can expert.

- A document-centric approach is important to possess tracking results and enhancing incentives.

Basic Solution Borrowing from the bank Relationship provides a keen FAQ page having methods to well-known questions relating to financial, in addition to questions relating to borrowing and you may debit notes. This really is particularly important to see if you are a bank that provides health deals membership and other points associated with fitness and you will wellness. Having an excellent copyright permit, your own party is show the information to the listeners, while you are getting the newest, legitimate and you will fascinating posts. A loan company or lender can do so it through providing downloadable possessions, in addition to financial management investment instructions, if you don’t free worksheets for thought and you can goal setting techniques. Of use posts, such as blog posts, infographics and you will movies, can help to inform audiences to your newest manner and you will things within the the new fund world.

If or not a potential customer experience the brand name for the social network or as a result of a timeless station such as direct mail, these power tools encourage these to take quick step on their own conditions. (Actually, 91% from People in the us state those features are very or a bit important whenever going for where you can discover a merchant account.) Financial institutions need to accept smooth electronic marketing methods, also. They encompasses a variety of issues intended for improving brand profile, drawing new customers, and you can fostering enduring matchmaking. Change their sale from the generating the globe-classification solution and personalized assistance thanks to plans designed with your own customer’s needs in the centre—you start with QR Rules and you can short website links. Out of banking companies and you can borrowing unions to help you brokerages and you may money organizations, loan providers have been basics of their groups for decades. That it state-of-the-art tech not just advances working efficiency and also assists banks understand buyers behavior and choice, providing them to provide customized choices (Everfi).

From the consolidating digital advertisements that have bank Search engine optimization steps and you will social media campaigns, you could nurture leads out of sense in order to conversion, no matter where he’s from the sales harness. By the using productive electronic steps, banks can also be reach a larger audience, improve brand profile, and take part users to your numerous systems. By making use of social networking effortlessly, banking institutions can also be strengthen the brand name exposure, engage their clients, and finally push organization gains.

Classes Advertisers Can also be Learn from This type of Ways

Individual expectations of convenience and you will customer care wear’t only apply to the new banking feel by itself—even when offerings including on the web banking and mobile applications are in fact very important to customers. Lender selling is the strategic way of product sales adopted from the loan providers to market the features and you can engage current and you may prospective clients. This type of characters can create content, endorse the lending company’s functions, and you can engage with their followers on the part of the lending company. By making use of chatbots, financial institutions could possibly offer twenty-four/7 service, address consumer queries inside the actual-go out, and you may boost complete client satisfaction. Millennials and Gen Z are two generations one financial institutions would be to spend close attention in order to when development its sale steps.

State-of-the-art Focusing on Possibilities

Recall, instead of almost every other features or organizations, the purpose of financial sale isn’t always campaign. Our advertising, but not, is tailored for the fresh banking world and you will produced by financial industry sales professionals along with your particular demands planned – your claimed’t find any of these product any place else. Several banking institutions purchased sale techniques you to took off using their audience. That it not only improves sales actions and you may customer wedding and also allows financial institutions to possess believe within the moving forward with your tips. With this opinions, banking institutions can also be efficiently flow having customer style through the years using study-determined knowledge. What’s more, over time, this may brand name a bank while the it’s looking after its people.

Concentrating on security measures, such a couple of-basis verification and genuine-time notice, financial institutions can be generate believe in the consumers regarding the shelter of the purchases. So it bank features effortlessly working Pay per click ads to market its around the world banking features. At the same time, A/B assessment various other topic traces and Seo blogs will help banks determine what resonates very using their audience, enhancing coming ways.