The better your property mortgage borrowing power, the greater amount of choices you’ll have. And also the good news is actually, there are lots of a means to assist in the borrowing from the bank skill In case your borrowing capacity is leaner than simply you’d including. All the details given does not create an offer from credit and does not make up the objectives, finances otherwise private items. We recommend seeking to independent financial, taxation and you will legal services to check on the advice offered aligns with your private items. Carlisle House’ Credit Energy Calculator is made to help you know your own borrowing from the bank capability, empowering you to definitely use the second step to your your dream home.

More questions regarding simply how much you could potentially use to possess a mortgage

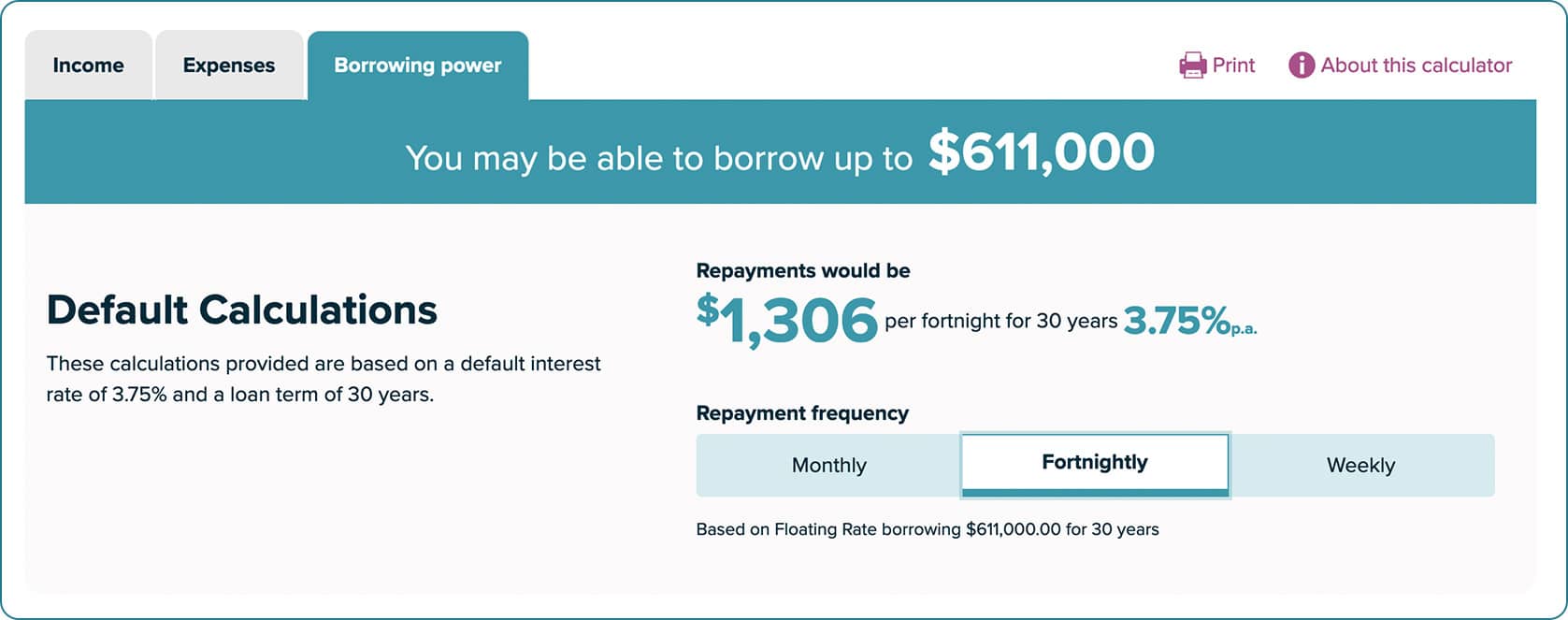

Such as, they may give a higher amount borrowed for those who’re also settling they more an extended name since your home loan costs might possibly be quicker. And if you decide to go to own a changeable interest financing more a predetermined rate financing, they’ll were a barrier (in australia, generally on the step 3% more than the interest rate they provide). All of our effortless-to-fool around with hand calculators assist estimate their borrowing from the bank skill, expected deposit and you can month-to-month costs. The support to shop for Plan is an additional solution, allowing earliest home buyers to buy a property that have in initial deposit as little as dos%. The us government is the owner of section of your property until you repay your loan, so you merely obtain what you could manage regarding the bank. Which doesn’t in person increase your borrowing limit, but through the elimination of the borrowed funds matter you want, it enables you to pay for a far more costly property than you possibly might otherwise.

See our very own complete rates & costs.

These could is mortgage origination charge, assessment charges, name insurance, attorney fees, and you will recording charges.

Explore our very own complete financial borrowing calculator to locate a far more in depth estimate of your borrowing electricity. Hook your day-to-day purchase membership on the offset variable rate family mortgage which could lessen the degree of desire you only pay on your own financial.

Talk about in the event the online mortgage brokers is actually a fit for you, providing versatile, imaginative solutions to explain and you can modernize your house investment procedure. Here are a few all of our almost every other hand calculators customized to help you manage your finances and you may understand your house financing possibilities. Created in cooperation having financial benefits, Carlisle Property’ Borrowing from the bank Strength Calculator reflects most recent Australian home loan requirements.

He’s in addition to a part away from both the Australian and you may The new Zealand Institute from Insurance coverage and you can Financing (ANZIIF) and the Financial and Finance Connection from Australian continent (MFAA). Principal component of a hypothetical home loan and, you guessed it, less borrowing energy. Appreciate an aggressive variable speed and you can financing have to provide the flexibility you need. There is a lot to consider when buying your first house, of preserving a deposit so you can deciding on the best loan – and you may we have been here to help you each step of the way.

The newest fewer debts you have, the low the new ratio – and the greatest the borrowing from the bank electricity may be. The amount a bank try ready to provide is actually at some point up to their discretion, but generally concerns considering the income once expenses and you can loan repayments. After that it uses so it shape in order to estimate how big of a good financing you could services at the current interest rates (in addition to a shield away from ~2-3%). Banking institutions and lenders are worried about ensuring that your payments try reasonable, and therefore your borrowing from the bank ability is related on the newest economic items.

Information about our terms & criteria, rates and you will charges & fees appear on the demand. Fine print pertain, make reference to their BankVic financial to learn more. Bank research cost usually give various other performance.Your Aussie Broker offer a far more precise credit strength estimate according to the financial preference. You’ll likely observe that one house affordability calculation has an guess of your own financial interest you will be charged.

This might let you use much more to own an alternative possessions, home improvements, and other investments. That have an excellent guarantor—tend to a close loved one—just who will bring their residence equity because the security is also rather improve your borrowing from the bank power. So it a lot more security lowers the lender’s risk, that may allow you to use many even help you avoid loan providers mortgage insurance coverage (LMI) when you yourself have lower than plain old deposit. Lenders usually evaluate their total income just after tax to check on your own power to service the borrowed funds (i.elizabeth. build costs). Highest money generally results in an elevated borrowing from the bank skill. Which have less otherwise lower an excellent debts, lenders will see that you have more income so you can solution your own home loan – and could probably improve your borrowing from the bank energy as a result.

Investment

It formula isn’t an offer out of credit which can be implied as the helpful tips simply. Loan providers usually place their particular maximums, however, usually won’t agree finance in case your DTI is too highest. Basically, an excellent DTI proportion away from 7 otherwise above is known as highest and you will could make loan acceptance tough. And you may a good 30-12 months loan label, they might be eligible for a home loan as much as $630,100000. Your details try gathered by Carlisle Home Pty Ltd and can be taken and you can kept according to our Online privacy policy. This information is obtained for the purpose of addition for the all of our communications database and for the intent behind delivering entry to key have to the our very own webpages.

Done Home buying Cost Calculator from the County

The interest rate you’re quoted might possibly be in accordance with a lender’s ft speed at the time which you use. A higher credit history, constant earnings and you can a strong advance payment is to put you from the the low stop of your own lender’s newest price products. Weaker financials and you will less credit history almost certainly imply a lender usually implement a more impressive margin on their base rates — lenders will require a higher interest for just what it understand as the an excellent riskier mortgage.

To own high rates, higher savings and you may great provider, Homestar Financing has you secure. Fill out your details to get in touch having a dedicated lending professional. You can also find an enthusiastic OwnHome Put Boost financing to attenuate the fresh initial can cost you of homeownership – and no LMI.